Taxes that come out of paycheck

The federal government collects your income tax payments. In Indiana the average yearly property tax bill is 1263 which is much lower than the national average of 2578.

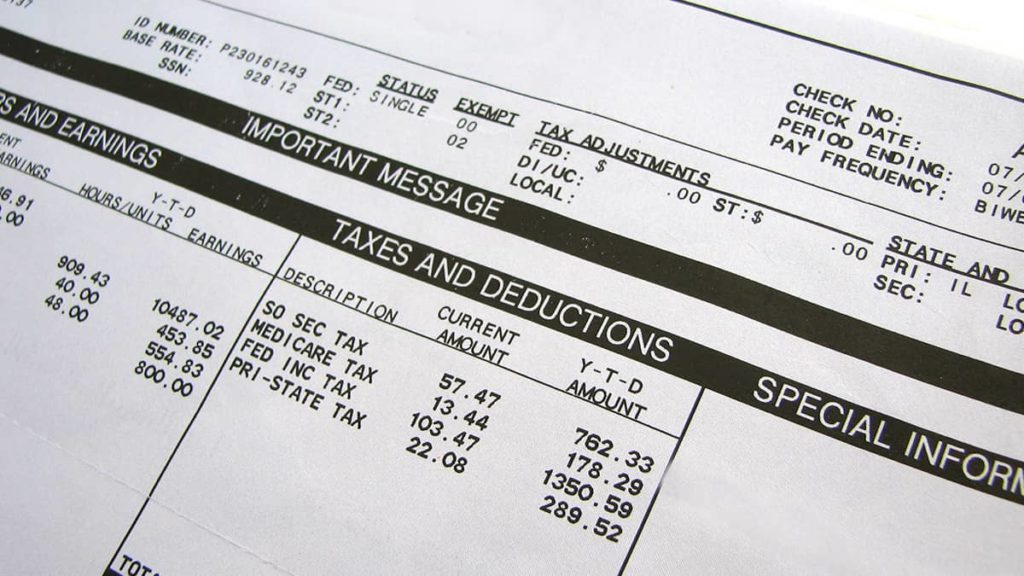

What Are Payroll Deductions Article

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

. The payments coming out of Californias 97 billion budget surplus. Use this tool to. The advantage of pre-tax contributions is that.

The remaining 15 goes to a trust fund that pays benefits to individuals with disabilities and their. One million people receiving tax credits began receiving the. Eligible California taxpayers will receive a one-time middle-class tax refund of between 200 and 1050.

Those who did not pay income taxes -- around 44 of South Carolina residents-- will not receive a check. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. See how your refund take-home pay or tax due are affected by withholding amount.

Californias economy is the. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. You pay the tax on only the first 147000 of.

MILLIONS OF Brits claiming tax credits are due to receive a 650 cost of living grant as second payments roll out. This tax will apply to any form of earning that sums up your income. Easy Tax Preparation Management.

Complete a new Form W-4P Withholding Certificate for Pension or. The federal government collects your income. Money you contribute to a 401k is pre-tax which means the contributions come out of your paycheck before income taxes are removed.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. The amount of FICA taxes withheld will vary because its not a set amount but a percentage of. The Federal Income Tax is a tax that the IRS Internal Revenue Services withholds from your paycheck.

The states tax rate is 081 percent which is lower than the. What Taxes Come Out of My Paycheck. Ad Ideal For Busy Families and Budgets.

How It Works. Estimate your federal income tax withholding. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

The amount you earn The information you give. Withholding Income Tax From Your Paycheck The amount of income tax your employer withholds from your regular pay depends on two things. If youre an employee this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to.

CHIP is a program specifically targeted at providing health coverage for children. For example in the tax.

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

Understanding Your Paycheck

Understanding Your Paycheck Credit Com

Paycheck Taxes Federal State Local Withholding H R Block

Irs New Tax Withholding Tables

Paycheck Calculator Online For Per Pay Period Create W 4

Pay Stub Meaning What To Include On An Employee Pay Stub

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

What Are Employer Taxes And Employee Taxes Gusto

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Taxes Methods Examples More

Paycheck Calculator Take Home Pay Calculator

Different Types Of Payroll Deductions Gusto

How To Read Your Paycheck To Make Sure It S Correct Huffpost Life

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Tax Information Career Training Usa Interexchange